BEACONS OF THE WEEK

The two main purposes of a Lighthouse are to serve as a navigational aid and to warn ships (Investors) of dangerous areas. It is like a traffic sign on the sea.

Faro Mazatlán, Mazatlán, México

Faro Mazatlán, Mazatlán, México

This lighthouse is located on the west coast of Mexico. The lighthouse was constructed in 1892 and stands at 36 feet tall. In 1933, an electric lamp replaced the hydrogen one and remained in operation until August 2021, when it was replaced by modern lighting equipment.

Ship Shoal Light, Gulf of Mexico (southwest of Louisiana)

Ship Shoal Light, Gulf of Mexico (southwest of Louisiana)

This lighthouse is a screw pile lighthouse located in the Gulf of Mexico. The lighthouse is currently abandoned. The lighthouse was first lit in 1859 and was automated in 1929. The lighthouse stands at 125 feet tall.

FED member speaks

FED Board member Neel Kashkari said in a statement this past weekend that if the FED were to cut rates, it would happen toward the end of the year. Kashkari said that the FED needs more data to justify policy rate changes.

Perhaps this is a move by the board member to dampen investor expectations or a signal that the FED will not cut rates before the Presidential election. Many have disagreed on whether the FED will cut rates close to an election as the FED is supposed to be an independent arm of the government.

We have been ready for higher for longer rates and have not positioned ourselves for numerous rate cuts this year.

Almost immediately after his statement, the CME FED Watch Tool target rate probabilities for the September FED announcement changed. The probability of a rate cut in September dropped by approximately 10%. There are only 4 FED meetings left in 2024, one at the end of July where the consensus belief is that the FED will hold rates in place once again. After July, there are meetings in September, November and December. The November FED meeting comes two days after the U.S. presidential election. Talk about a volatile week.

We are not sure what the FED will do but we believe rates will be higher for longer as inflation remains above the FED’s 2% target. The FED cannot change its target inflation rate, or the public will lose confidence in the organization.

We will continue to comment on where interest rates are moving throughout this year. It seems each month’s inflation data will be uber important as we head closer to September’s FED meeting. Inflation and price control is one of the key issues in the upcoming election.

The greenies go nuclear

And just like that the green energy team has come around on nuclear energy. It took a while and it was a slow pivot, but it seems the green energy team is now accepting nuclear energy. Nuclear energy has long been compared to fossil fuels and was not considered a clean energy source like solar or wind. This is due to the nuclear waste that is created in the nuclear energy process – numerous accidents also made many weary of the energy source. We have long said that nuclear energy is the key to a net zero world and the key energy source that countries will need to reach their climate goals over the next 20+ years.

Slowly countries, governments, companies, and advocacy groups have warmed up to nuclear energy. They realize nuclear energy is reliable like fossil fuels and clean like solar and wind. You get the best of both worlds. And for now, the risk of an accident seems contained and something the world learned from in past decades. Governments around the world have begun to build nuclear reactors to increase their nuclear energy capabilities. We have commented on this in past issues of this publication. Countries across Europe, the U.S., and East Asia are piling into nuclear energy and are following the lead of France, who have the largest dependence on nuclear energy in the world. Countries are also attempting to secure domestic or ally-sourced uranium and decrease their dependence on Russia which is a global leader in uranium mining and enrichment. Countries across Europe understand the risks of depending on Russia after the recent Russian invasion of Ukraine sent oil and gas prices across Europe surging.

We bring this all back up this week because one of the world’s leaders in green energy advocacy spoke out in support of nuclear energy moving forward.

Bill Gates, one of the richest men in the world is an outspoken green energy supporter and promoter. He has strong beliefs that we need to lower the temperature of the Earth and embrace renewable energy sources.

Gates said at an energy conference that he is willing to pour billions into nuclear power. We are pleased to hear this as we have been in the nuclear energy and uranium trade for quite some time.

We think the spot price of uranium has a lot more upside from here and certain uranium producers that boast strong management, strong balance sheets, and strong hedges will be solid performers moving forward. The global supply of uranium will simply not meet the global demand moving forward which will cause prices to rise. We think demand will continue to rise as the world goes greener and greener and wake up to the realization that in current form many renewable sources of energy are not extremely scalable.

We will have to see if this changes anything in the uranium trade but appreciate the billionaire’s bump. Spot prices of uranium have pulled back slightly over the last 2 months but are poised to return to new highs. If you have no exposure, it could* be a good time for entry.

*could be – meaning – timing is everything in investing. Speak to your Advisor or we would be pleased to have a chat.

If you want to learn more about uranium and why we have exposure in client accounts, contact us today at info@macnicolasset.com

Disclaimer: MacNicol & Associates Asset Management holds various uranium-related securities in client accounts including uranium miners, and physical uranium trusts.

Oh say can you see

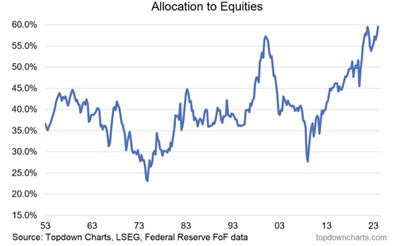

Foreign investors have piled into U.S. assets for the last 15 years. They have run to the safety of the world’s largest, and most innovative economy. The U.S. is home to the world’s biggest, and most successful companies. These companies are continuously innovating and are at the forefront of new technology, and products globally. These companies are considered the safest bets in equity markets across the globe. The same can be said for U.S. bonds, the U.S. Dollar holds its value better than any other currency and is the world’s reserve currency. A flight to safety does not only mean investors buying U.S. Dollars and U.S. debt but also U.S. equities. The recent melt-up that we have seen in foreign exposure to U.S. equities also reflects the exit by many global Central Banks and institutions away from U.S. Treasuries and into other assets like U.S. equities.

This trend has accelerated since the Covid-19 flash crash of 2020. Since that bottom, foreign investors have increased their allocation to U.S. equities as a percentage of their overall U.S. allocation from 45% to 60%.

60% represents an all-time high for this data set. The previous all-time high was seen a year before the dot com crash in the early 2000s when foreign investor exposure to U.S. equities reached 57% of their total U.S. allocation.

We understand why foreigners have piled into U.S. assets. The U.S. economy and its largest companies have roared for 15 years. Investors have fled global assets (and equities) for a variety of reasons – slow earnings growth, poor economic growth, geopolitical risk, political risk, and deteriorating purchasing power. However, we think the chart is a bit overdone and is due for a correction. We understand the rotation from U.S. treasuries and U.S. Dollars to U.S. equities is partially due to inflation, and rising interest rates. However, the magnitude of this change could be a contrarian signal, especially as the overall allocation to U.S. assets from foreign investors has accelerated over the last 20 years.

So, if this chart is bound to correct slightly, where will investors rotate to? Well obviously, nonequity U.S. assets like debt, U.S. dollars, and private assets but when we think of the overall 20-year trend of foreign exposure to U.S. assets increasing, something must give.

The chart below shows the ownership share of the overall U.S. equity market by investor type from 1950 to 2020. Foreign ownership of U.S. equities increased from 5% in 2000 to 16% in 2020, quite the jump as foreign investors rotated hundreds of billions into U.S. equity markets.

We think some U.S. assets held by foreigners will rotate into the highest growth areas of the world which include emerging markets. We think emerging markets with strong relations to the developed world will capitalize on the rotation away from China. These areas, for the most, part have huge growth prospects that could increase as corporations rotate away from enemy countries like China and Russia.

When servicing debt goes wrong

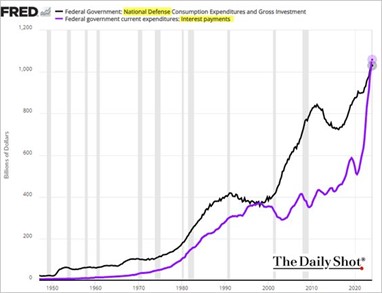

For the first time, U.S. government interest payments over a year will surpass the U.S. government’s defense budget.

Both spending items have surpassed $1 trillion but one has surged by much more since 2021. What happened in 2021? The Federal Reserve began to increase interest rates to combat sky-high inflation.

The annualized interest payment on debt is currently $1.059 trillion, but interest on debt in May was over $100 billion and is already on pace for $1.2 trillion over the next 12 months. However, the U.S. government is expected to add another $2 trillion in debt over the next 12 months which could grow interest payments.

The biggest loser of rising rates in dollar value is the U.S. government who owe over $34 trillion in debt. They have serviced this interest rate payment increase by increasing the deficit but how high can debt get before the government is forced to slash spending in other areas?

Many expect interest on debt to exceed social security payments in the next few years to become the largest item in the budget.

The U.S. government is spending and looks like it will continue to spend itself into oblivion.

Another one bites the dust

Fisker which was founded in 2016 went public in 2020 via a reverse merger with a SPAC company. The EV start-up launched its first EV about a year ago, the Ocean SUV. The company follows other EV producers like Lordstown Motors and Arrival who have already filed Chapter 11 filings.

The company has raised more than $1 billion from investors but building a profitable car company costs a lot more than that. Tesla raised over $9 billion in cash before it generated profits and positive cash flows. Fisker paused production earlier this year due to cash restrictions, it had previously forecasted 21,000 vehicle deliveries in 2024 and delivered roughly 5,000 last year.

At Fisker’s Q4 2022 earnings call in February 2023, Fisker’s management claimed the company would produce 42,400 vehicles in 2023 and potentially reach profitability in late 2023. Quite the shortfall for the company. However, this is an industry-wide issue. Companies forecasting ridiculously unattainable numbers and falling completely flat. All they do is temporarily prop their stock up for a few months. Perhaps they are doing this to allow for time to pass and unlock restricted shares so shares can be sold by Insiders at higher prices. This is purely speculation.

These production and earnings misses have piled on for Fisker and have tanked its stock price. Quality concerns have also worried investors in recent years from the actual car to its software. Shares have collapsed from their debut of $10 in 2020 to $0.021 today after bankruptcy filings. Fisker shares reached an all-time high of $28.50 in February 2021. Shares have mostly collapsed since November 2021.

Magna International built the Fisker Ocean at its plant in Austria and took a $316 million asset write-down related to Fisker earlier this year.

We will have to see how these bankruptcy filings unfold and if any company with a lot of cash (wink, huge tech companies) wants to enter the car market and acquire Fisker and its debt load for pennies on the dollar.

We are glad this was a trend we completely avoided over the last few years. We warned our readers since this publication’s inception that many of these EV producers presented huge risks and could potentially go bankrupt due to the capitally intensive requirements across the industry. Even if they avoided bankruptcy, early investors would face heavy dilution from future raises. Many of these companies also went public via SPACs when liquidity was running rampant through the global economy through government stimulus. These companies also did not belong in the public arena as they were still in their early stages and many retail investors were caught holding the bag in what they thought and were told would be “the next Tesla”.

We hope you avoided the hype.

Fisker’s bankruptcy filing is another sign of the broader headwinds the industry faces as consumers are not switching to EVs from traditional cars as fast as many thought. The market also looks like it could be drying up as prices seem to be a major barrier for consumers. Another obstacle for many consumers remains the time it takes to charge as well as the lack of charging infrastructure across Europe and North America. Today it is still a challenge to travel with an EV across certain routes even in the developed world and it is also more time-consuming due to the time it takes to charge many EVs.

We are sure the industry along with its leaders will solve some of these issues, but we still think adoption for consumers will be slower than many in the industry think which could impact forecasts for years to come from companies. We also believe Tesla and traditional automakers will be the dominant players moving forward as no EV startup (ex. China) has shown huge scalability in the space.

MacNicol & Associates Asset Management

June 21, 2024