We trust you’ve enjoyed a refreshing break and are prepared for the year ahead.

Before we proceed with this month’s market update, a quick reminder: The content you’ll find here isn’t intended as investment strategies or tax advice. For personalized guidance, consult with a qualified professional.

You can find the full disclosure statement here.

Alternative Asset Trust Fund Update

Music Royalty Investments

Let’s commence with an overview of our investments in the music royalty sector. Leveraging our partnership with ICM, we’re pleased with the data we’re receiving.

This investment model ensures regular monthly payments, with occasional additional dividends or royalty payments. Notably, our most recent venture entails a collaboration with Mike and Keys, a prominent duo hailing from Los Angeles, renowned for their influence within the hip-hop scene, an endeavor that sparks considerable enthusiasm within our team.

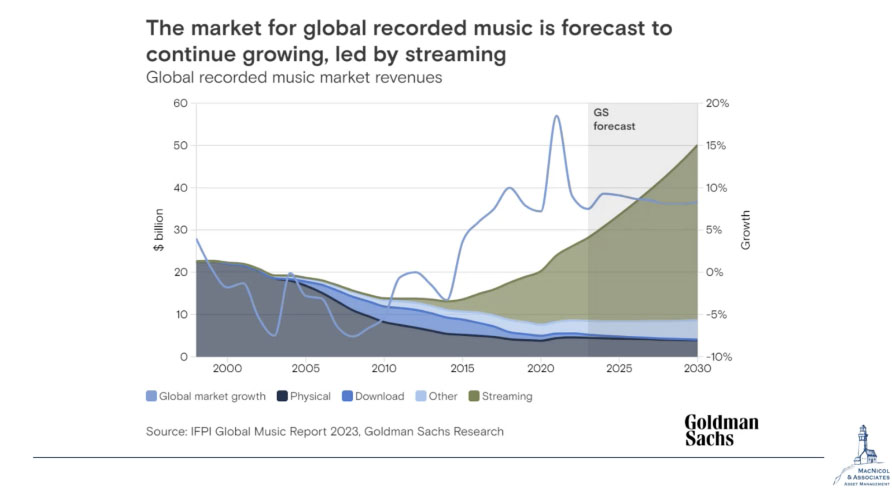

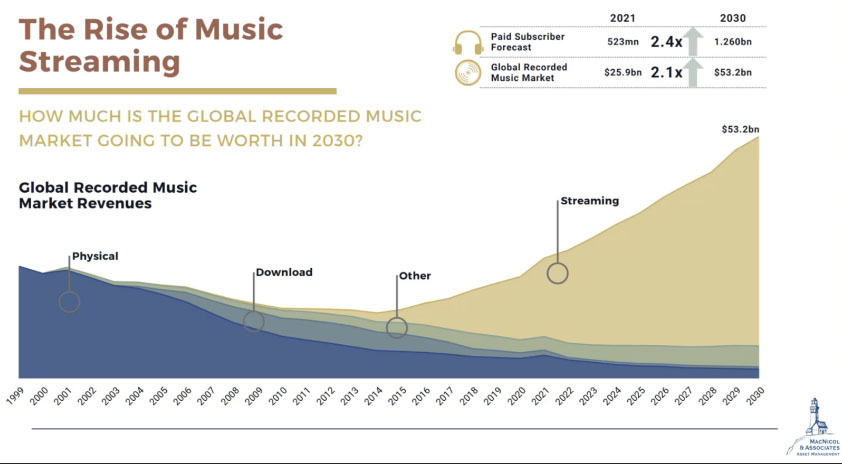

While we appreciate working with talented individuals, our primary motivation for entering this space is driven by our focus on secular growth themes that offer immediate benefits to our investors, such as royalty streams from music investments. We found Goldman Sachs’ report titled “Music is in the Air” particularly enlightening. Diving into the data, we’ve uncovered fascinating insights reminiscent of a Goldman Sachs opus, ‘Music is in the Air.’ This comprehensive sixty-page report resonated with us, highlighting the pandemic’s role in boosting music streaming—a climax in a long-term upward trend.

Let’s pause and reflect on the evolving music landscape. Remember cars with CD players? They’re becoming a rarity, symbolizing a significant shift from tangible media and downloads to the ubiquitous world of streaming. The days of physical music formats and MP3 players are fading out, giving way to streaming’s growing dominance.

Looking at the graph below, it underscores the secular trend of increasing demand for streaming services, a trend that we believe will persist. The shift away from physical music formats like CDs and MP3 players towards streaming services is undeniable. The rise of streaming music is substantial, as indicated by the valuation chart below, surpassing $50bn.

This growth trajectory excites us, and we remain impartial to individual music preferences, emphasizing strict business evaluation criteria. At MacNicol, we don’t just listen to music; we listen to the market. Our investment strategy is like a well-composed piece, focusing on secular growth themes where we can channel our investors’ capital into generating tangible benefits. Consider it as royalties becoming a financial melody, providing a steady cash flow beat.

Market Updates

S&P 500 Trends and Support Levels

A quick overview of the public markets, the S&P 500 saw significant upward movement last year.

Last year, the S&P 500 experienced a significant upward trend, particularly noteworthy at the end of the year. It established a support level at 4,700 in December, which is where it stood as of January 4th. This level is crucial for us; a drop below it could indicate the first sell signal since October. We’re closely monitoring this as the S&P 500 has been overbought for the past month, reaching 80% this week. This marks the fourth consecutive week above 80%, the longest streak since pre-COVID, likely driven by investor FOMO at the year’s end.

TSX60 Breakout and Prospects

Turning to the TSX, it broke out over the holidays, surpassing the 1,240 to 1,255 zone. This is a significant development, as this zone has been a focal point multiple times in the past year – in December, February, May, July, September, and earlier in December. This range has been consistently highlighted in our market analysis for advisors. The TSX reached its highest point since April 2022, a positive sign. We anticipate a continued breakout, especially in material stocks which we believe are undervalued. Despite recent declines in the oil industry, we see potential upside moving forward.

From a technical standpoint, there have been two consecutive months of positive momentum, with the TSX being the only North American index that flipped in December, as most others did in January. This could be a leading indicator for future trends.

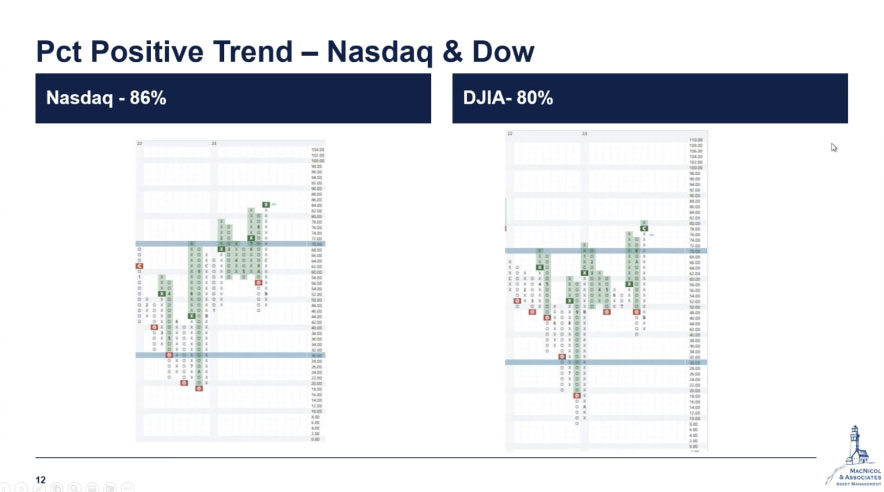

Nasdaq & Dow

Additionally, we examined the percentage of stocks trading positively on both the Nasdaq and Dow.

Of note is the Dow’s first buy signal since last summer. This is notable because, until now, value stocks had been lagging growth stocks.

Reaching an eighty percent level on this chart is a significant milestone for the Dow. It’s the first time it has achieved this since the end of 2021. This return to the eighty percent level after quite some time is noteworthy. We anticipate this trend could continue, especially considering the movement of larger value names within the Dow in the future.

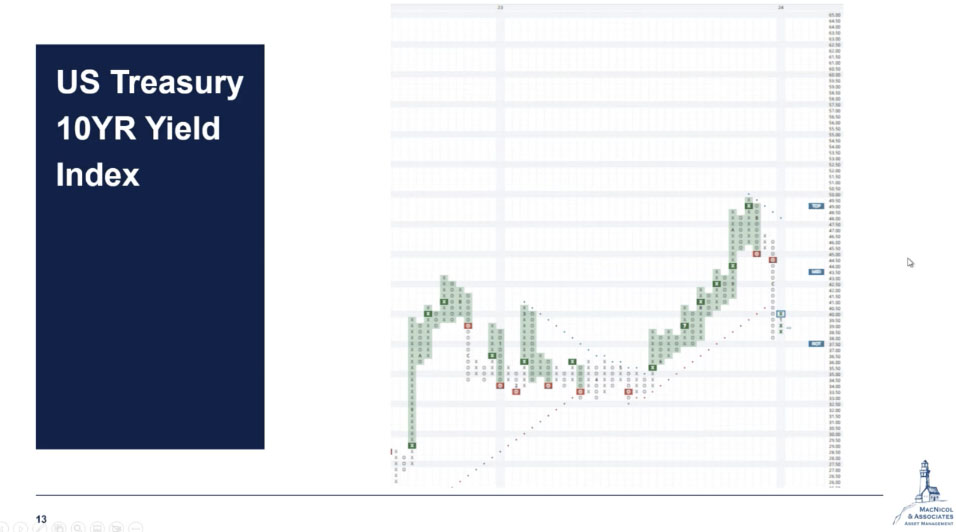

Treasury Bond

In our examination of the 10-year treasury bond, and across the yield curve at the year’s end, marked by two sell signals. The rate of the 10-year treasury bond, at one point, was 3.75%, having briefly touched 5% in October. By the end of the year, it dropped to as low as 3.8% but began to increase following the Federal Reserve meeting. Federal Reserve officials hinted at the potential for more rate hikes rather than cuts at the start of the year. The likelihood of a rate cut in March decreased by about 25% following the release of the Fed minutes. This shift is critical, as yields might start to rise again after the short-term decrease seen at the year’s end.

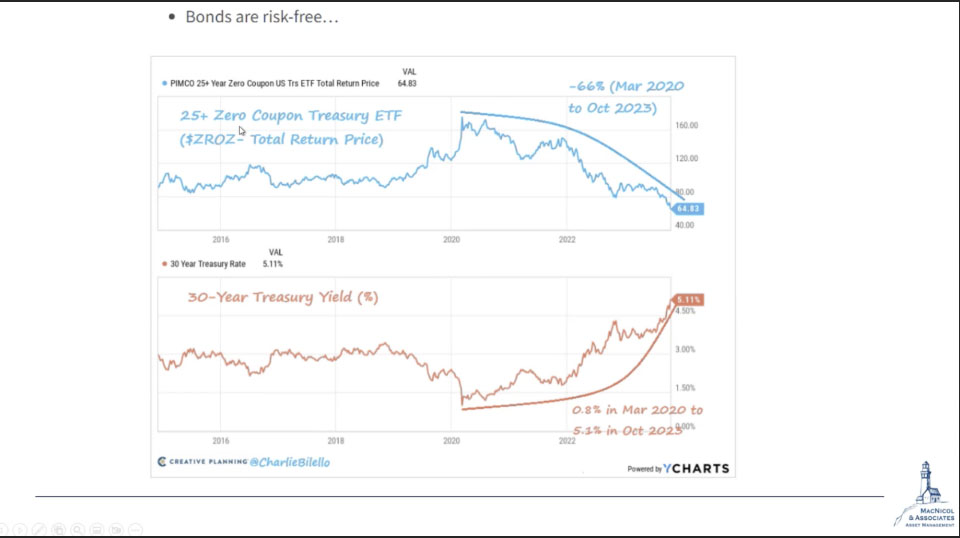

Now, let’s take a look at a chart that highlights a 25-year zero-coupon treasury ETF, which has fallen by 66% over a three-year period. This decrease is significant, especially for an asset often considered risk-free. The fall was driven by the 30-year treasury yield rising from below 1% to about 5.1%. Those who secured fixed-rate mortgages at these lower rates are in a favorable position.

However, we anticipate challenges for the traditional 60/40 investment strategy, especially if interest rates continue to rise and we see a resurgence, albeit moderate, in inflation. This situation suggests we may face higher rates for an extended period.

Crude Oil Trends and Market Outlook

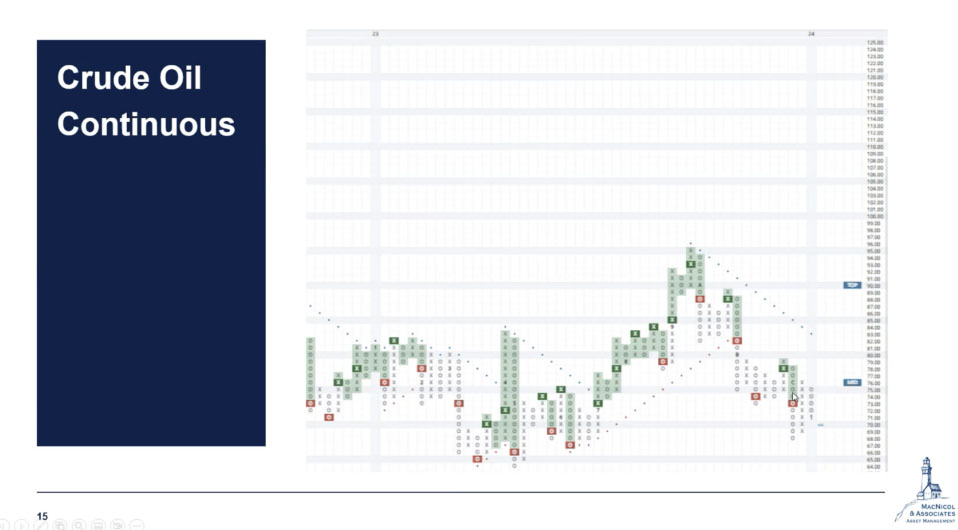

We’ve closely monitored crude oil, particularly focusing on the crucial $68 breakpoint. Recently, there’s been talk of demand destruction and a slowdown in the global economy. However, this view isn’t entirely aligned with the equity markets, which have been surpassing recession concerns and reaching all-time highs. An exception to this trend is the oil industry, which has experienced struggles in the last two months, despite a general surge in equity markets. Notably, there was a $10 drop in oil prices during this period.

Our mid to long-term outlook on oil remains bullish. OPEC and OPEC Plus have reinstated their production cuts and recommitted to their agreement. It will be interesting to see how this impacts the oil market this year.

Turning our attention to the EWW, this is a Mexican ETF for which we have a very positive outlook. Mexico, as one of our top emerging market picks, has shown strong performance. I recommend visiting our website for a detailed analysis of our thesis on the Mexican market. There, you’ll find various videos and commentaries discussing Mexico’s growth prospects and reasons for our continued bullish stance on its market, particularly after its impressive performance last year.

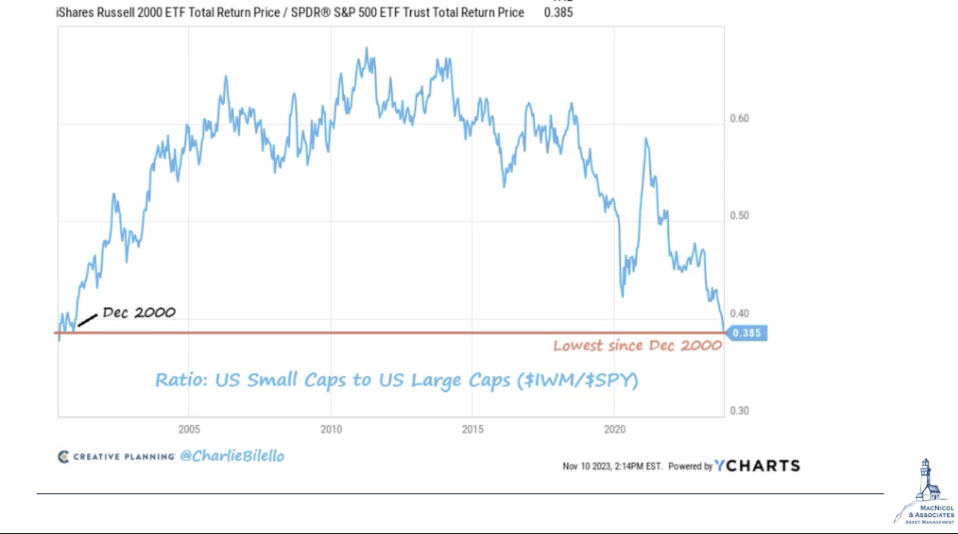

Lastly, let’s examine the ratio of US small caps to US large caps, currently at its lowest point since December 2000. This period reminds us of the dot-com bubble, where large caps in the US predominantly led the market. Similar to the trends observed in the 1990s, this chart has been trending downwards, particularly over the last six to nine years.

Several analysts have pointed out that this ratio is at a notable low, suggesting the potential for a bounce back. This could signal a period where small caps begin to outperform large caps on a relative basis. It’s something we’ll be watching closely to see if it unfolds in 2024.

This concludes January’s market update. We hope that our market analysis and commentaries have given Registered Investment Advisors (RIAs) some insights into the state of the financial and economic landscape.

If you have questions, please reach out to us and we’d be happy to help!