Beacons of the Week

The two main purposes of a Lighthouse are to serve as a navigational aid and to warn ships (Investors) of dangerous areas. It is like a traffic sign on the sea.

South Eleuthera Lighthouse, Eleuthera, Bahamas submitted by D.M.

South Eleuthera Lighthouse, Eleuthera, Bahamas submitted by D.M.

The South Eleuthera Lighthouse, also known as Bannerman Lighthouse, is located on the south point of Eleuthera. This out of commission lighthouse was used for commercial ships passing by. However, the island has a new resident, Disney, which opened a resort right down the street from this lighthouse this summer. The beautiful island will forever change with this influx of tourism and commercialization.

Thomas Point Lighthouse, Chesapeake Bay, Annapolis, Maryland submitted by Bret B.

Thomas Point Shoal Lighthouse is a historic lighthouse located off the east coast. The lighthouse stands at 13 meters tall and opened in 1875. The U.S. Coast Guard continues to operate the lighthouse as an aid to navigation.

*Feel free to send us your photos of Lighthouses to be featured in our weekly market observations.

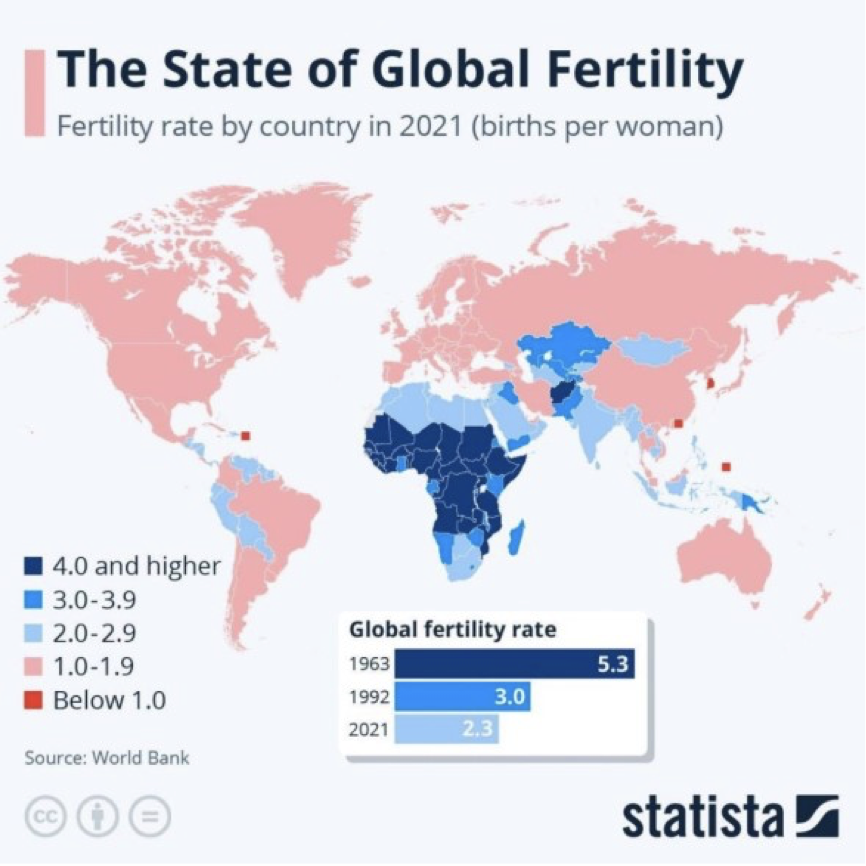

Growing problem

The population is having fewer babies in developed nations which is creating an issue, an aging population with fewer people to look after them. This lack of new births will also impact the workforce down the road as fewer and fewer people will be entering the workforce.

In Germany, this issue has accelerated, and the country will have 5 million fewer workers by the end of the decade.

Who is supposed to pay for the pensions and health care of retirees? This is a real problem that is being overlooked and one that plagues most of the Western world. The population is simply having fewer babies and many people are taking a pass on being parents.

Take a look at this chart below which exemplifies the problem that Germany faces. The world will face this same issue but on a larger scale.

As the workforce shrinks, the number of retirees increases, and population growth slows, there are several issues that society will have to tackle that they have not dealt with in the modern world. The health care industry which was stretched during COVID-19 will have to drastically improve to support this aging population. The world will certainly need more health care workers, and support workers to assist new retirees. Unless some massive innovation takes place in the healthcare industry, we think prices could rise as demand increases moving forward.

We will end this entry with a few simple questions for our readers. Feel free to reply with your answers or discuss with friends and family.

Why have birthing rates decreased so much? Are people not having kids due to the costs of raising children? Do you think Western healthcare systems are set up for this increased demand moving forward? How can the education system promote work in the healthcare industry more?

Regulatory update

U.S. markets shifted to T+1 on Tuesday after their long weekend. Just a day earlier Canada and Mexico made the same switch. Although the announcement was made months ago, we wanted to let our readers know now as the change is now active.

So, what do we mean by T+1?

T+1 references the days it takes for an exchange-traded security trade to settle. It will now only take a trade date plus one business day for settlement compared to a trade date plus 2 business days before this change. This is the first time in 100 years that the U.S. has been on the T+1 system.

The change is ultimately intended to reduce risk in the financial system. However, there are worries about potential teething issues, including international investors struggling to source dollars on time. The SEC hopes everything will run smoothly but noted that there might be a short-term uptick in settlement fails and challenges to a small segment of market participants.

Firms across the industry have been prepping for this change for a few months, relocating staff, adjusting shifts, and overhauling workflows.

We will have to see if there are any short-term issues with this change. The one thing we do know is investors will have quicker access to cash if they sell a security.

Say hello to lettuce wraps

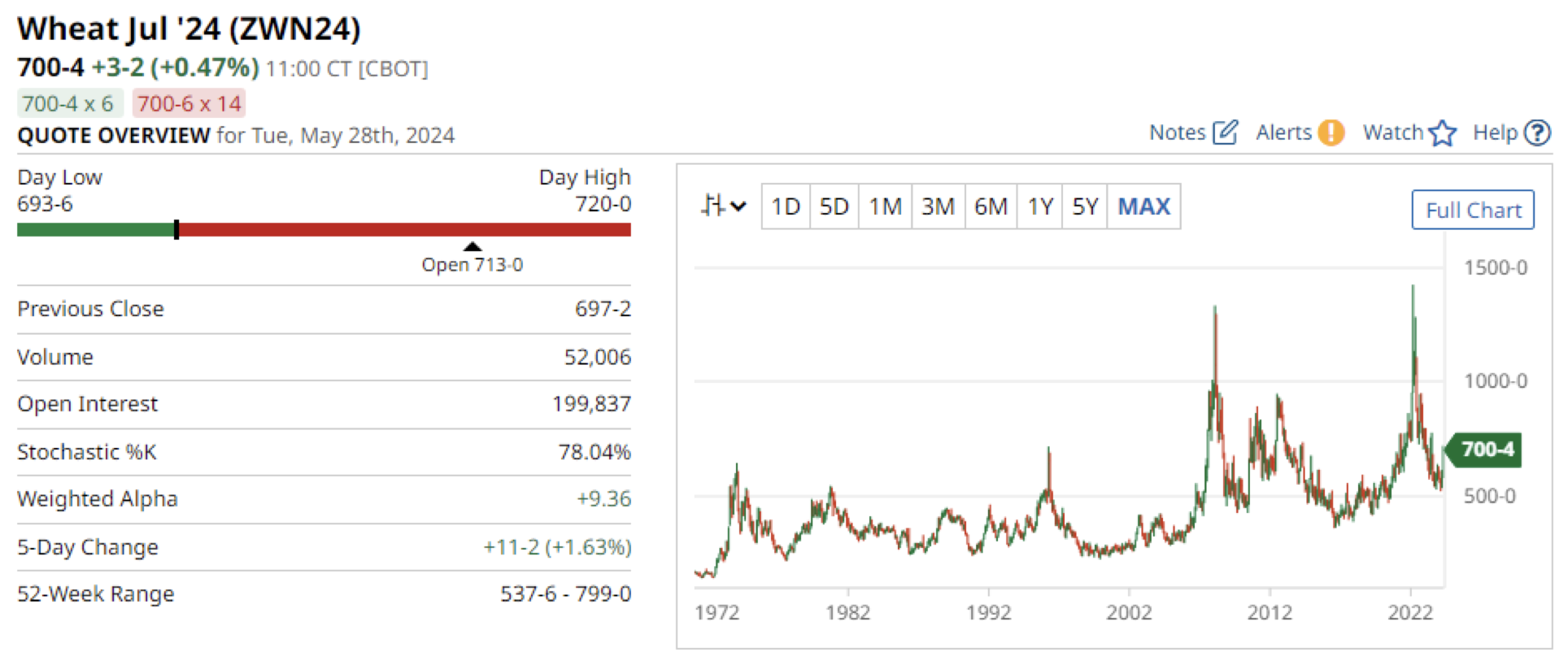

Quietly wheat prices have surged over the last month hitting a 10-month high.

Wheat futures are up 18% over the last year, and 15% over the last month.

Wheat prices are trading well above their historical averages and have yet to return to their pre-COVID- 19 levels. We know the recent tick-up is not much when you stretch the chart out but it’s been enough to set off some alarms across the world.

However, prices are well below the levels seen shortly after the Russian invasion of Ukraine. Russia is the world’s largest exporter of wheat and that is forecasted to continue to happen.

Over the last month, Russia has stepped up its bid to control more of the industry. Last year Western merchants, Cargill and Viterra pulled back from Russia due to Russian government pressure to make way for domestic firms. However, this year even private Russian firms are having issues with the Kremlin. This puts the market in the hands of fewer companies all of which have or have had ties to the Kremlin.

The Russian government has long desired to control the commodity world and their moves in the wheat industry are further cementing that quest.

Russia’s natural gas industry has always been dominated by the government. Its oil industry has been state and ally-controlled since Putin won the election and now the government is looking to tighten its grip on an agricultural commodity.

3 of the top 10 exporters of wheat in Russia stopped last year due to government regulation and interference. Russia has targeted Western firms operating within its borders since invading Ukraine. It has targeted anything from a pasta producer to the Russian subsidiary of French yogurt makers. The Kremlin is essentially forcing these private companies’ hand to either a forced sale to the government or sell to an ally of the Kremlin as it targets “unfriendly” countries.

However, this consolidation of the industry in Russia around the government has made it hard for traders to get information on things like crops and volumes. Traders have cut production targets for Russian producers this year due to dryness and prolonged frost. This has been one of the major contributors to higher wheat futures and has reignited food inflation worries around the world.

The International Grains Council expects Russian wheat output to decline by 6% this year.

Despite the run-up we have seen in recent months, there are fewer worries that prices will reach 2022 highs due to better prospects for U.S. crops.

The key question for the industry is how Russia’s grain consolidation will impact the world market. Russia has already tried to unofficially set a minimum price for its crops. The one difference in the government’s approach to the wheat industry by the Kremlin compared to energy markets is that they have not yet directly disrupted supply. However, with the Kremlin, anything is on the table.

The top four traders in Russia now account for 75% of the country’s exports compared to just 45% six years ago. Consolidation is real and Russia means business.

Long real assets.

U.S. telecommunication company makes a move

T-Mobile U.S. agreed to acquire most of U.S. Cellular this week in a bid to fend off competition. U.S. Cellular is one of the last major regional wireless carriers in the country.

T-Mobile will pay approximately $2.4 billion in cash and assume close to $2 billion in debt to buy out the company’s wireless operations and approximately 30% of its spectrum assets.

Access to spectrum is the biggest announcement in this deal for T-Mobile. The more frequency a company has the right to use, the greater the speed, coverage, and capacity of a carrier’s network. This is critical as competition among telecoms has intensified in the U.S. recently.

T-Mobile shares moved up slightly on this announcement. Its shares are trading just off its all-time high. Shares are up 24% over the last year. United States Cellular Corp. saw its shares jump by 7% on Tuesday after the deal announcement. T-Mobile shares have outperformed its biggest competitors’ shares over the last year by over 10%.

U.S. Cellular will retain 70% control of its spectrum assets and will reportedly seek to monetize these assets opportunistically. T-Mobile gets access to 4.5 million of U.S. Cellular’s customers. The company offers services to many rural areas in the Midwest, something T-Mobile has been targeting for quite some time.

Gaining subscribers is appealing to T-Mobile but the problem is nothing is stopping these customers from switching to another network.

The market’s muted reaction to this deal stems from regulatory approval worries. It has become increasingly difficult to win approval from regulators in tech, media, and telecommunications under the Biden administration.

Do not expect the deal to pass anytime soon. Regulatory processes have taken quite a time recently. T- Mobile’s acquisition of Mint Mobile took over a year in a simple acquisition that did not involve infrastructure or spectrum assets. This suggests a longer scrutiny and approval period for this deal.

We will be watching this deal closely. This deal could give T-Mobile a nice leg up on Verizon and AT&T, the other two major telecommunications companies in the U.S.

Market concentration

Over the last year or so, we, along with many other market participants have talked about how concentrated the market has become. Mega-cap tech stocks have their largest weightings in the S&P 500 ever. The Magnificent 7’s weight across indices has surged over the last few years.

This week we ran a chart that we wanted to share with our network which shows how large a percentage the top five largest stocks make up in the S&P 500.

Currently the top 5 make up over 27% of the S&P 500, double the weight from a decade ago, and 8% higher than 18 months ago.

Currently, the top 5 make up over 27% of the S&P 500, double the weight from a decade ago, and 8% higher than 18 months ago.

As of this writing the top 5 weights of the S&P 500 are Microsoft, Nvidia, Apple, Amazon, and Alphabet. What a diverse basket of stocks!

Some of the causes of this concentration at the top have been the growth in popularity of passive investing, robo-advisors, and investors fleeing to mega caps when worried about markets.

We think the chart above will break down and indices will eventually become more diverse once again. We also think passive investing could struggle in years to come. We think active management will be a must moving forward and managers will have to earn their fee by displaying true alpha.

A chart with no context

The inflationary waves that we saw in the 1970s fear many investors. We have said for quite some time that today’s inflation will remain elevated and that we could see multiple waves of it. This week we saw a chart online that illustrates this comparison quite well.

Take the graph as you will:

Fast fashion stalls

Fast fashion giant Shein saw its IPO hopes stalled this week as its NYSE hopes have faded. Shein offers consumers ultra-low-priced clothing pieces. Their prices have helped them grow into one of the world’s biggest fashion companies. The company has hundreds of millions of customers.

As equity markets roared in 2023, Shein wanted to capitalize on the state of markets and their momentum with an IPO on the NYSE. Shein filed in November with expectations that it would be one of the biggest IPOs in years.

Shein’s U.S.-based executive has flown across the U.S. to meet with politicians, selling them on his company’s compliance and transparency.

Despite those efforts, Shein is now stuck between U.S. and China trade tensions and its NYSE IPO hopes have seemingly faded. Shein was founded in 2012 and moved its headquarters to Singapore in 2021 but remains heavily tied to China today through warehouses, distributors, and manufacturers across the country.

Shein’s largest market is the U.S. and the most ironic part of it being stuck between the CCP and U.S. government is that it has never sold products in China.

Shein failed to bridge the gap between Washington and Beijing over the last few months. U.S. lawmakers are reportedly suspicious of Shein’s ties to China and have demanded more details on its supply chain. Beijing however wants Shein and other companies with substantial operations in China to stay in line with CCP messaging.

Shein has rotated its IPO efforts in recent weeks to London. Many believe a Shein IPO on the London Stock Exchange could come in the next few weeks.

Shein was last valued at $66 billion according to its NYSE filings in November. The company reportedly was seeking a valuation in the range of $80 to $90 billion. However, due to recent investigations, their IPO valuation will more than likely fall short of that range.

Either of those valuations listed above is greater than the market capitalizations of numerous well- known clothing retailers including Adidas, Lululemon, H&M, Prada, Ralph Lauren, and Gap Inc.

Shein is not the only company that is facing the wrath of geopolitical tensions between the world’s two largest companies. ByteDance (TikTok’s parents’ company) has faced similar issues in recent months. We will, however say that a social media platform is more powerful and dangerous than a clothing manufacturer and should be more heavily scrutinized.

We are not sure how this story will unfold and if Shein will ever get on the NYSE, but continue to watch carefully. We can confidently say things are not getting better between the two nations and an East- West decoupling seems more and more likely every day. Do not expect any new China IPOs in the U.S. anytime soon.

Lesson of the week

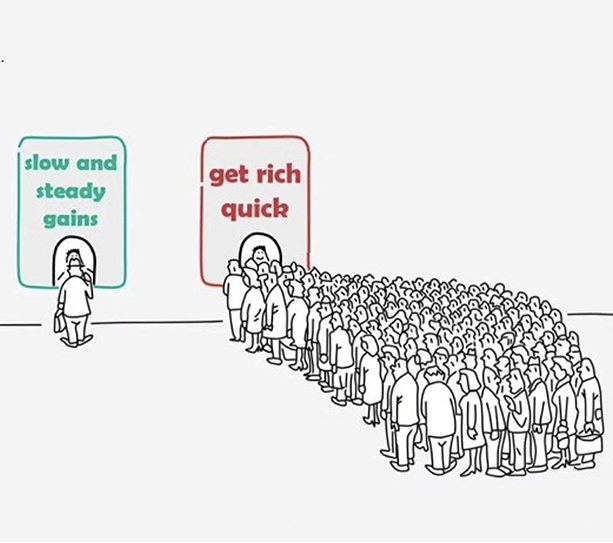

A little lesson to end the week from an image found by our President David MacNicol. A picture says 1000 words:

It seems more and more investors want the get-rich-quick handbook and will risk it all to achieve it. It’s why there are so many gurus online selling “get rich quick” courses. People are as impatient as ever.

As a conservative wealth manager, we understand the importance of patience and not chasing returns. Slow and steady compounding is our goal with your wealth and it’s how some of the best investors ever made their names.

Remember investing is for the long term, and trading is for the short term. Capital markets often transfer wealth from the inpatient to the patient.

MacNicol & Associates Asset Management May 31, 2024