Following Fitch’s credit rating downgrade, the S&P500 dropped four notches. But how bad is it? Could one economic event impact the global financial market?

In this edition of The Monthly Update, we’ll share our analysis of the key market trends to help equip you in making informed investment decisions. We’ll also provide the latest update on one of our alternative investments and our position in the company.

But, before we dive into the details, please read our disclosure here.

US Market Overview

August has brought forth several noteworthy shifts in the financial markets. One of which involves Fitch and its move to downgrade the US government’s credit rating. Following the announcement, the S&P500 dropped four boxes from its previous position.

Despite this, the chart below shows substantial support at nine boxes lower, so there’s no need to panic.

And while both S&P500 and NASDAQ have experienced a slight downturn from their recent peak, they continue to exhibit signs of being overbought. There is still large investor demand, but as we’ve mentioned before, the S&P500 and NASDAQ are a lot more susceptible to downside risk compared to their more value-oriented counterparts like the Dow. As such, a degree of caution is recommended in considering these indices.

Canadian Market Overview

Going up north, we see that the Canadian index wasn’t avoidant of the US downgrade. It experienced a dip, mirroring the broader trend.

If you analyze its performance this year, you’ll see that it has been relatively weak, punctuated by positive upturns in July. While this uptick is encouraging, we’re still waiting for a more positive performance. However, we remain bullish on the TSX60 as a whole, due to its components.

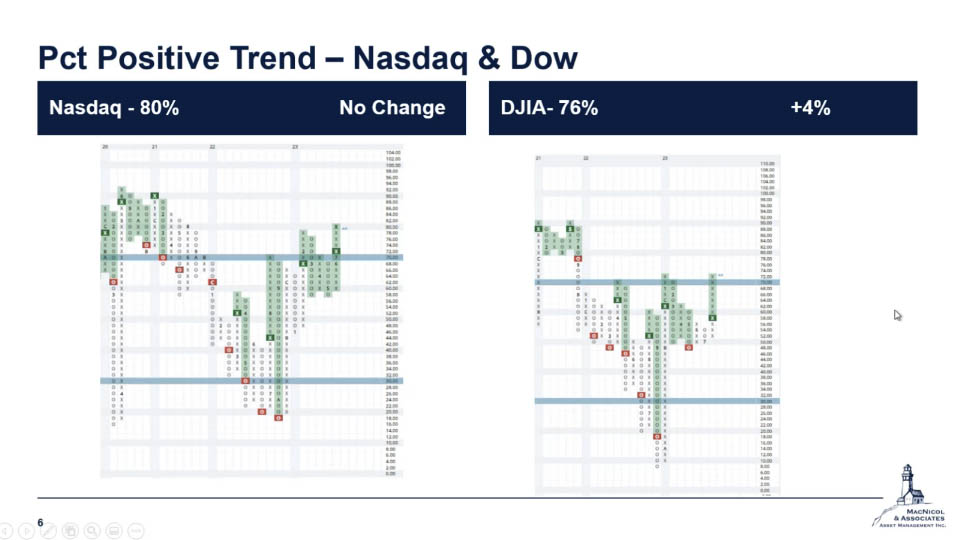

Percent Positive Trend

Percent positive trend is a technical indicator we monitor closely. It tracks the proportion of stocks within each index that are displaying positive trends.

It’s worth noting that though NASDAQ shows a strong performance this year, it’s nowhere near the highs we saw back in 2020 and 2021. While certain stocks within the index may show rapid changes and a potential downward shift, we think there is some support there at 58%.

On the other hand, the Dow is lagging a little. The stocks are trending positively, moving up to 76% from 50% last month, indicating a significant turnover. Previously struggling stocks transitioned to a more favourable course, with notable positive earnings reports from large-cap stocks within the Dow 30.

One of these is Caterpillar, which has reported record-breaking numbers. We’re excited to see what happens with the more value-oriented index moving forward.

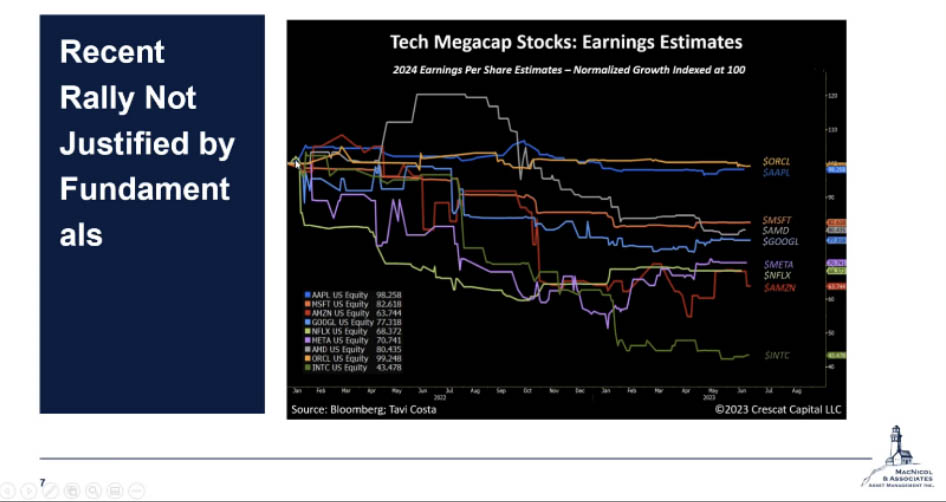

A closer look at NASDAQ

And then looking closely at the tech stocks, NASDAQ is trading at a premium compared to other indices. The graph below shows the earnings per share estimate from January 2022. Banks and market strategists are the ones who predict earnings for the companies. The chart below reflects the anticipated earnings of the world’s largest tech companies since January 2022 (subject to revisions).

The evident trend reveals a downward shift in earnings, indicative of reduced consumption and recession concerns. However, this has not triggered a complete reversal of US indices this year. These indices have been influenced by prominent mega-cap tech stocks, even though their earnings forecast have decreased over the last 18 to 20 months.

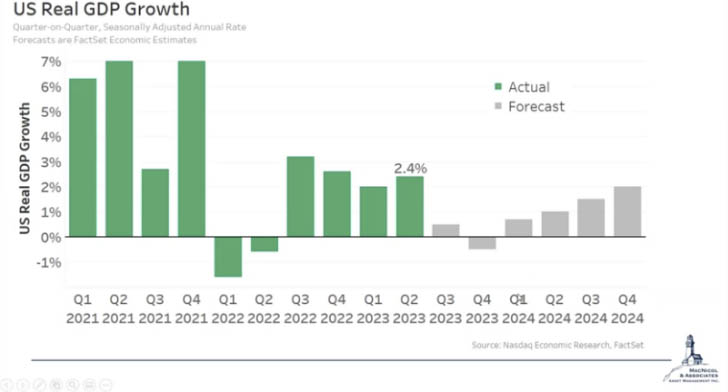

US GDP Growth Forecast

The GDP growth forecast shows a decrease in economic activity in the fourth quarter of this year, but then a bounce back through all of 2024 is forecasted to be at 2.4% growth.

It beat many estimates, which might give the Fed and other central banks some signs that they might still be able to continue with their monetary policy decisions, but we’ll have to see what happens next.

The forecast also indicates one more interest rate increase this year, followed by potential cuts in the subsequent year. Sadly, anticipated cuts this year are not expected to happen, as many investors hoped for.

Investment Opportunities

Amidst evolving market conditions, certain investment opportunities call for a closer look. Crude oil, for instance, experienced a decline last month and displayed a somewhat horizontal pattern. However, we observed a rebound above 80. Stockpiles have also decreased.

With a recent 17 million draw in the US, oil prices have risen by approximately $10USD, which is a positive sign. While acknowledging the fundamental nature of the commodity markets, we remain confident in the existing fundamentals of the crude oil market and see a favorable risk-reward ratio moving ahead.

As we continue to deplete stockpiles, companies are inclined to limit exploration and reduce capital expenditures.

Alternative Asset Update: Real Vision 2.0

Finally, we are excited to announce that we have increased our asset allocation to Real Vision. We provided a convertible loan to the company, which can be turned into shares if needed.

This investment aims to support their platform expansion, allowing them to evolve beyond a communication services company.

The vision is to become a real-time data hub, comparable to a mini-Bloomberg terminal, for investors.

This strategic move aligns with their substantial investment in technology, enabling subscribers to access real-time economic data and customize their dashboards based on their needs. It will also allow subscribers to add their portfolio to the platform, giving tools and insights to assess their risk levels and market exposure.

Real Vision’s upcoming prototype is expected to be released around September. Additionally, the company plans to introduce services such as live call transcripts, note-taking features, and video-saving options. The goal is to create a personalized platform tailored to individual needs, attracting a diverse consumer base and positioning Real Vision as a prominent player in the industry.

We are pleased to share our involvement in this expansion through the provision of a loan, granting us both protection and potential equity returns. Our position in the capital structure provides added security, while the option to convert the loan into shares offers equity-related benefits down the line.

For more in-depth analysis, regular updates, and personalized guidance, we invite you to register to our content library or connect with our team of experts.